Where do fraudsters come from

From the 1st of February exemption for the South Australian conveyancers to complete the VOI requirements for a client situated interstate was removed.

With this change, it’s important to emphasize that fraud does occur frequently in this country and VOI plays a very important role in protecting practitioners.

As part of the Veda Group we operate within the fraud on line security section with Australian businesses, governments, enforcement agencies and individuals, to provide shared insights, analysis and anti-fraud products and services.

Cybercrimes continues to evolve and morph as cyber criminals respond to security technology improvements. Common types of cybercrimes include identity theft, online scams, and fraud involving the buying and selling of property. The commonality in cybercrimes is the criminal’s objective to steal information from victims for their own benefit.

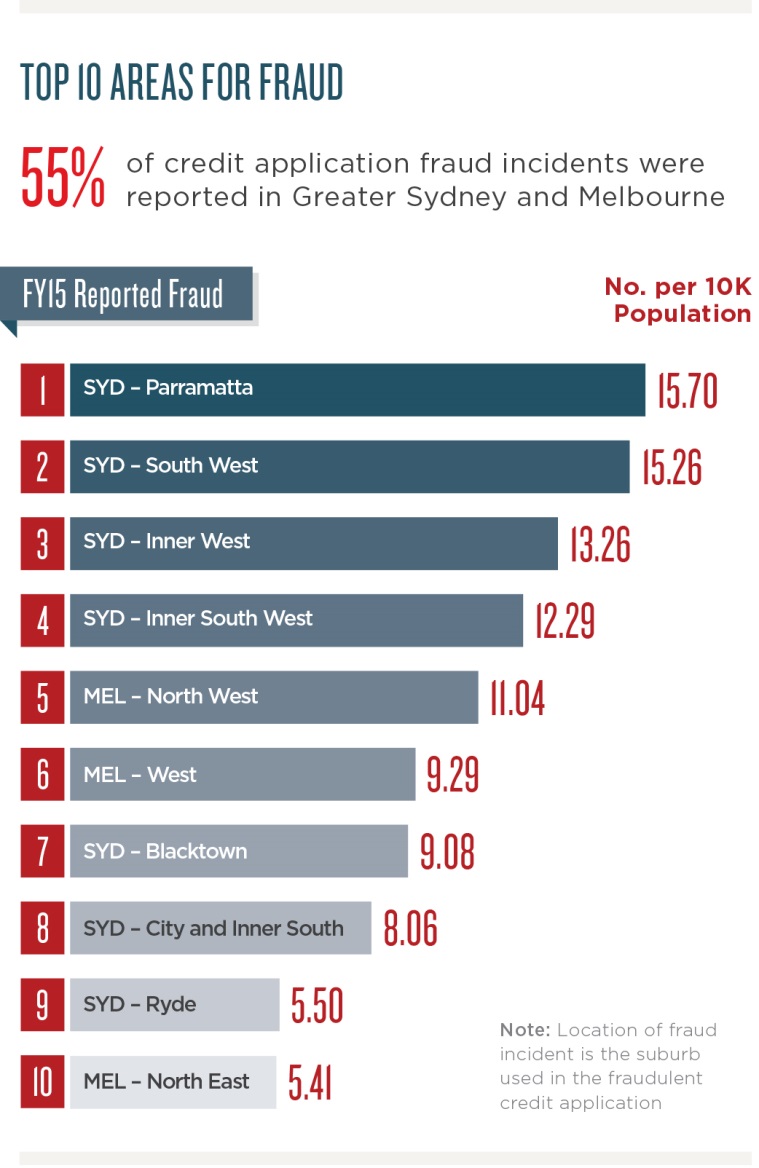

Figure Seven: Top 10 Areas for Fraudulent Credit Applications (Veda Shared Fraud Database 2015).

Stealing personal information from individuals allows criminals to do more than just steal money. They may also create rumours, conduct illegal activities, perform blackmail or expose sensitive facts about individuals, firms or governments. They may use a victim’s account as s mule account to launder money or fiancé terrorism.

The mechanism to extract financial advantage depends on the sophistication of the criminal. Through phishing or a direct hack, a criminal may access a password and username that allows them to operate a victim’s online account for the purpose of transferring funds or buying goods and services. A more sophisticated crime might involve the theft of a person’s identity, so criminals can buy and sell assets or apply for credit in the victim’s name.

In 2015, 55% of the addresses used in fraudulent credit application were in Greater Sydney and Melbourne. The worst area per capital for fraudulent credit applications was Sydney’s Parramatta, followed closely by South West Sydney. Outside Sydney, Melbourne’s North West Region ranked fifth worst nationally.

While fraudulent applications for credit may be concentrated in Sydney and Melbourne, the impact on victims of credit application fraud does not respect state or national boundaries.

Veda’s 2015 consumer survey found an even spread across the states and territories of people reporting they were the victim of fraud:

|

27% |

25% |

24% |

23% |

18% |

|

NSW |

QLD |

VIC |

WA |

SA |